Analysis of China's new energy vehicle market in 2020

- Share

- From

- www.askci.com

- publisher

- Gordon

- Issue Time

- Mar 16,2021

Summary

Affected by the new crown epidemic, the auto market will slow down in 2020. Driven by factors such as the improvement of the epidemic, the resumption of work and production, and policy support, the auto market is gradually picking up. In particular, the new energy automobile industry chain will usher in the resonance of the three factors of policy, sales volume, and performance, which will become a good performance in the auto market last year.

AskCI: A few days ago, 12 departments including the Ministry of Commerce issued the "Notice on Several Measures to Boost Bulk Consumption and Promote the Release of Rural Consumption Potential", which put forward the stabilization and expansion of automobile consumption. Unleash the potential of automobile consumption, encourage relevant cities to optimize purchase restrictions and increase the number of license plates; launch a new round of car going to the countryside and trade-in for new ones; strengthen the construction of parking lots, charging piles and other facilities.

Affected by the new crown epidemic, the auto market will slow down in 2020. Driven by factors such as the improvement of the epidemic, the resumption of work and production, and policy support, the auto market is gradually picking up. In particular, the new energy automobile industry chain will usher in the resonance of the three factors of policy, sales volume, and performance, which will become a good performance in the auto market last year. With the arrival of 2021, a new round of promotional fee policies will once again be applied to the new energy vehicle market, and the industry prospects are bright.

A review of the new energy vehicle market

in 2020

(1)

New energy vehicles

In November 2020, the new energy vehicle market performed

outstandingly. Sales this month showed a substantial increase, achieving the

fifth time this year to refresh the historical record of the month. The

cumulative sales growth rate has turned from negative to positive. The new

energy vehicle market has gradually recovered its vitality in the second half

of the year. In addition, according to statistics, as of the end of 2020, the

number of new energy vehicles in the country reached 4.92 million, accounting

for 1.75% of the total number of vehicles, an increase of 1.11 million vehicles

from 2019, an increase of 29.18%. Among them, there are 4 million pure electric

vehicles, accounting for 81.32% of the total number of new energy vehicles. The

increment of new energy vehicles exceeded 1 million for three consecutive

years, showing a trend of sustained high-speed growth.

Data source: Compiled by China Automobile Association and

China Commercial Industry Research Institute

Data source: Compiled by China Automobile Association and

China Commercial Industry Research Institute

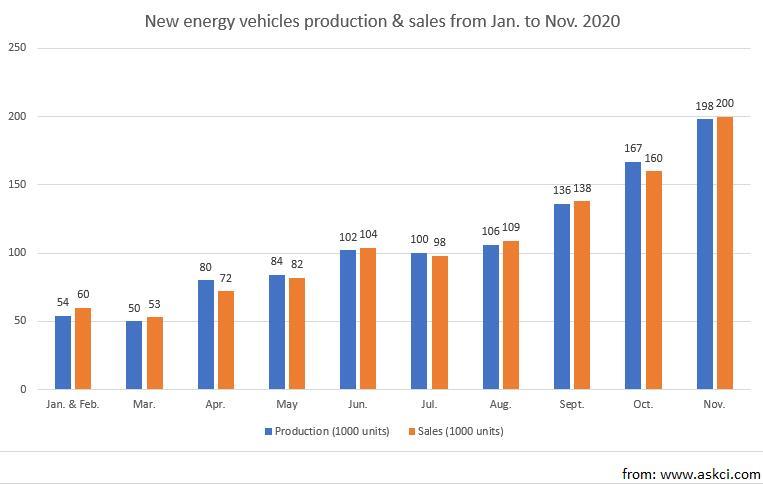

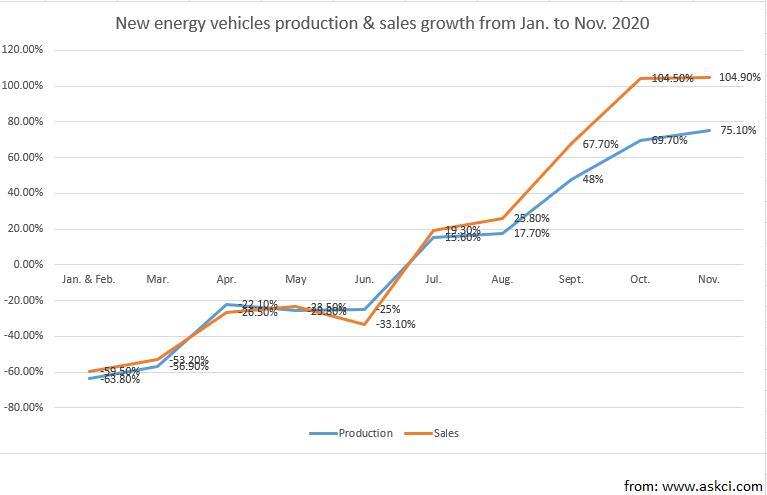

The data shows that in November 2020, the production and sales

of new energy vehicles were 198,000 and 200,000 respectively, an increase of

75.1% and 104.9% year-on-year, respectively. Its monthly production and sales

set a new historical record for the fifth time in a single month. Cumulatively,

from January to November, the production of new energy vehicles was 1.119

million, a year-on-year decrease of 0.1%, and the decline was significantly

narrowed by 9.1 percentage points from January to October. The sales of 1.109

million vehicles were completed, a year-on-year increase of 3.9%, and the

growth rate was 1- It has been changed from negative to positive in October.

1.

Pure electric vehicles

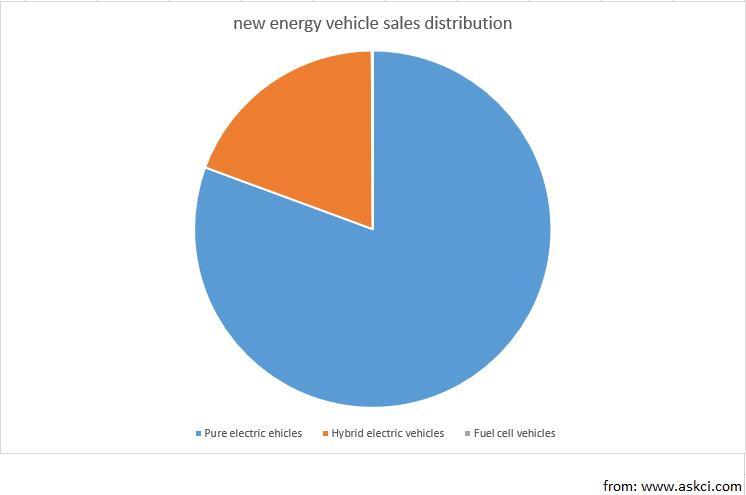

In the current Chinese new energy vehicle market, the production

and sales growth of pure electric vehicles is the main driving force for new

energy vehicles. Among them, the sales of pure electric vehicles account for

over 80% of the new energy vehicle market.

Data source: Compiled by China Automobile Association and China

Commercial Industry Research Institute

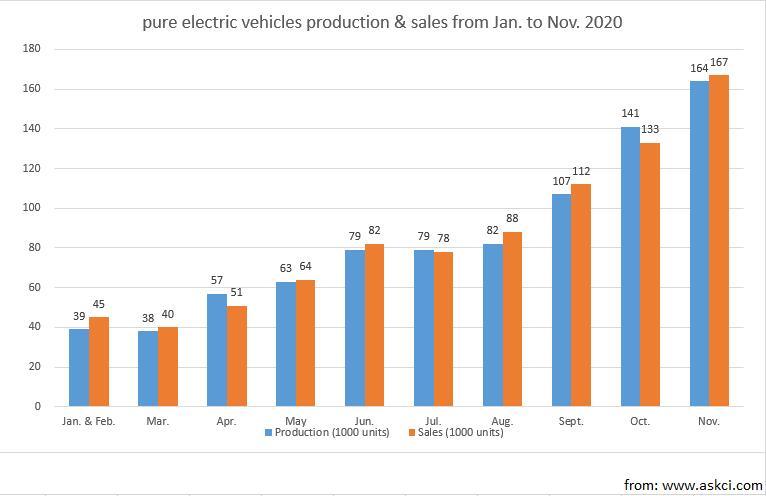

According to statistics, from January to November 2020, the

production of pure electric vehicles was 890,000 units, a year-on-year decrease

of 3.1%, and the sales were completed at 894,000 units, a year-on-year increase

of 4.4%. Among them, in November, the production and sales of pure electric

vehicles were 164,000 and 167,000 respectively, a year-on-year increase of

66.2% and 100.5% respectively. From the perspective of growth, the production,

and sales of pure electric vehicles in the second half of the year also turned

from negative to positive. Among them, sales growth in October and November

exceeded 100%.

2.

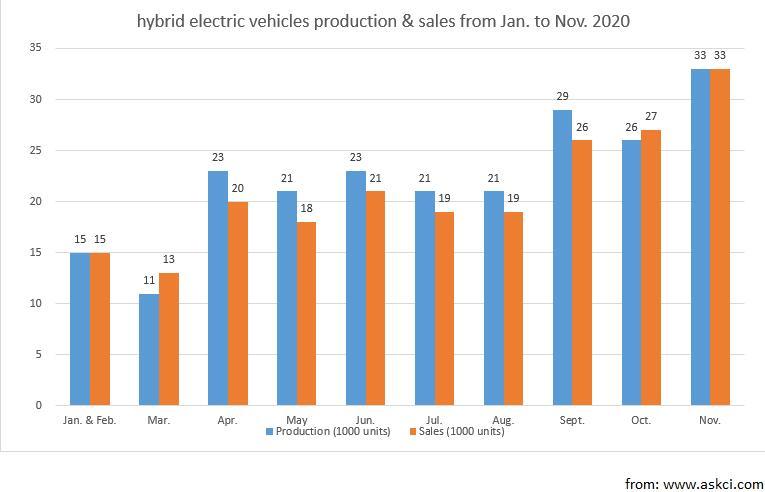

Hybrid electric vehicles

The data shows that from January to November 2020, the

production and sales of plug-in hybrid vehicles were 228,000 and 214,000,

respectively, an increase of 13.8% and 1.8% year-on-year. Among them, the production,

and sales of plug-in hybrid vehicles in November were both completed 33,000

units, an increase of 136.4% and 128.9% year-on-year respectively.

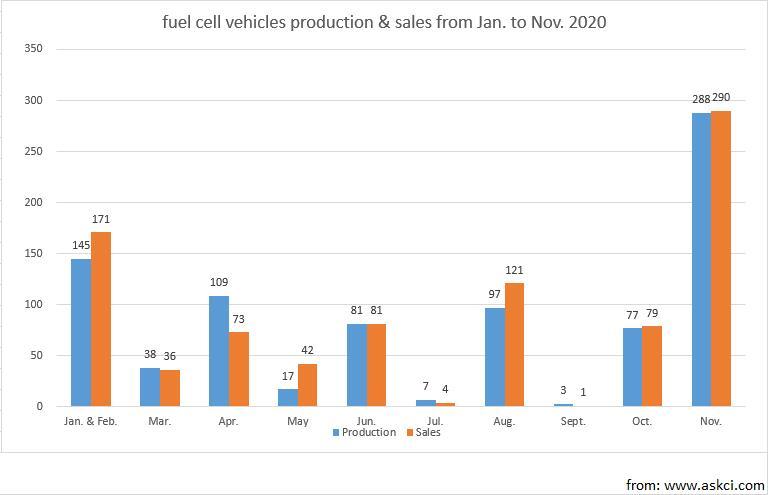

Although the fuel cell vehicle market is not as mature as

electric vehicles, it is still an important trend in the development of new

energy vehicles in the future. The data shows that from January to November

2020, the production and sales of fuel cell vehicles will be 935 and 948,

respectively, a year-on-year decrease of 34.4% and 29.1%. Among them, in

November, the production and sales of fuel cell vehicles were completed 288 and

290 respectively, an increase of 7.2 times and 28 times respectively

year-on-year.

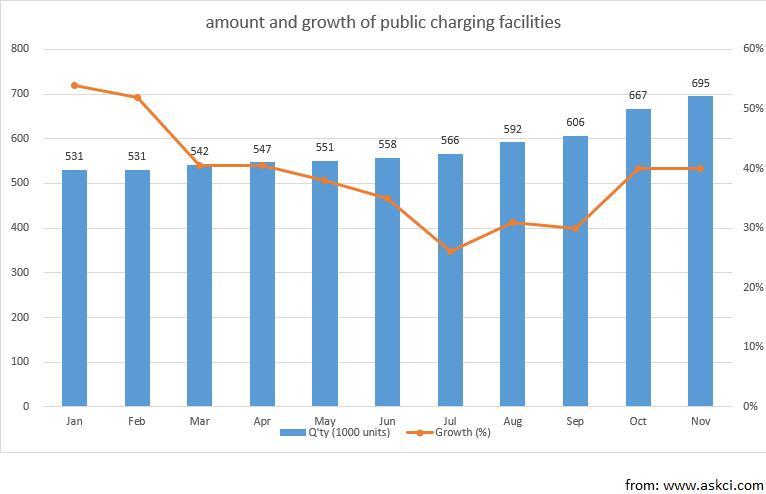

(2) Charging infrastructure

As the scale of the new energy vehicle market continues to

expand, the demand for charging infrastructure for new energy vehicles has

increased. In 2020, our country's charging infrastructure construction will be

further promoted, and the number of charging piles and charging stations will

increase steadily.

The data shows that as of November 2020, member units of the

alliance have reported a total of 695,000 public charging piles, including

397,000 AC charging piles, 297,000 DC charging piles, and 488 AC-DC integrated

charging piles. From December 2019 to November 2020, about 17,000 public

charging piles were newly added every month. In November 2020, the number of

public charging piles increased by 29,000 compared with October, and in

November it increased by 40.3% year-on-year. Near the end of the year,

operators have increased the investment and construction of public charging

piles, resulting in a significant increase.

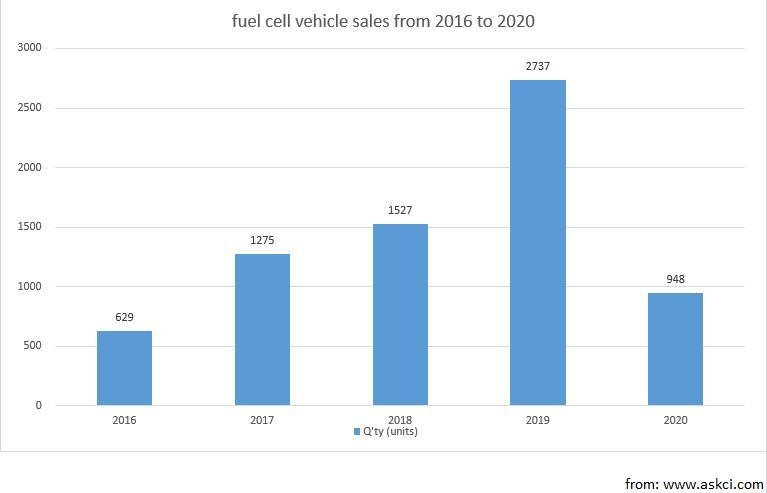

(3) Steady development of fuel cell

vehicles

In recent years, our country has attached great importance to the research and development, promotion, and application of fuel cell vehicle technology. With favorable policies, fuel cell vehicles seem to be in the air. From the perspective of promotion in our country, there is still a lot of room for growth. The data shows that between 2015 and 2019, the sales of fuel cell vehicles in our country were 10, 629, 1275, 1527, and 2737 respectively. The sales volume in 2019 was 272.7 times that of 2015. In addition, according to the latest data, from January to November 2020, the production and sales of fuel cell vehicles will be 935 and 948 respectively.

According to Hewu Wang, deputy secretary general of the China Electric Vehicles Association, by the end of 2020, our country will strive to achieve a scale of nearly 10,000 hydrogen fuel cell vehicles. Hydrogen energy is regarded as one of the most promising clean energy sources in the world. In recent years, the popularity of the hydrogen energy industry has increased year by year. In the previous important documents such as the "National Innovation-Driven Development Strategy Outline" and other important documents issued by the state, it was clearly mentioned that the development of hydrogen fuel vehicles should be vigorously promoted. By 2030, our country will achieve the goal of 2 million hydrogen fuel cell vehicles. In addition, the Chinese Society of Automotive Engineering has predicted that by 2030, the output value of our country's hydrogen car industry is expected to exceed the trillion-yuan mark.

(4) Speed up the construction of

charging/replacement infrastructure

With the promotion and application of new energy vehicles, the

demand for charging and replacement facilities is also increasing. At the same

time, complete supporting facilities will also benefit the promotion of new

energy vehicles. As the sales of electric vehicles continue to improve, the

number of new public charging piles is gradually increasing. In addition, swap

stations have also been developed. Electric vehicle battery swap mode refers to

the centralized storage, centralized charging, and unified distribution of many

batteries through centralized charging stations, and the battery replacement

service for electric vehicles in the battery distribution station or the

charging of battery collection, logistics deployment, and battery swap

services. One.

During the "14th Five-Year Plan" period, our country

will vigorously promote the construction of charging and swapping networks and

speed up the construction of charging and swapping infrastructure.

Scientifically layout the charging and replacement infrastructure, and strengthen

the overall coordination with urban and rural construction planning, power grid

planning, property management, and urban parking. Relying on the "Internet

+" smart energy, improve the level of intelligence, actively promote the

smart and orderly slow charging as the main charging service mode in

residential areas, and the emergency fast charging as the supplementary, and

accelerate the formation of a moderately advanced, fast charging as the main

and slow charging as a supplement Highways and urban and rural public charging

networks encourage the development of battery swap mode applications,

strengthen the research and development of new charging technologies such as

intelligent and orderly charging, high-power charging, and wireless charging to

improve charging convenience and product reliability.

(5) Frequent investment in power batteries

For new energy vehicles, the battery is the most critical

component, and it is also one of the hot investment areas in the industry

chain. According to different cathode materials, power batteries can be divided

into ternary material batteries, lithium iron phosphate batteries, lithium

manganese oxide batteries, lithium cobalt oxide batteries, and so on.

In the power lithium battery industry chain, the cathode

material has a large market scale and high output value. Because its

performance determines the energy density, life, safety, and application fields

of the battery, it has become the core key material of power lithium batteries,

accounting for power lithium the battery production cost is about 30%. At

present, among the installed capacity of power batteries, the cathode materials

that account for a relatively high proportion are mainly lithium iron phosphate

and ternary materials.

Thanks to the rapid development of domestic new energy vehicles,

our country's cathode material output has grown rapidly, and it has become the global

largest supplier of cathode materials. According to statistics, China's cathode

material shipments account for more than 40% of the global cathode material

shipments, with a compound growth rate of about 30%, maintaining a good growth

momentum. At present, the electric vehicle market is still not saturated, and

the future holdings will further increase, which will drive the investment

prospects of the lithium battery market.