The only rare earth mine in the United States has a Chinese background, and plans to have processing capacity at the end of next year.

- Share

- From

- guancha

- Issue Time

- May 28,2019

Summary

The only rare earth mine in the United States has a Chinese background, and plans to have processing capacity at the end of next year.

The only rare earth mine in operation in the United States is changing its business model due to trade frictions.

On May 26, the South China Morning Post reported that as the victim of trade friction in the world's two largest economies, Las Vegas-based MP Materials (hereinafter referred to as MP material) will be launched before the end of 2020. Own processing ability.

Currently, the company is developing the Mountain Pass rare earth mine in California, the only rare earth mine in the United States still in operation. Reuters reported that the mine exports nearly 50,000 tons of rare earth concentrates to China each year for further processing.

It is worth mentioning that the Mountain Pass rare earth mine is also one of the largest light rare earth mines operating outside China. In June 2017, A-share listed company Shenghe Resources (SH.600392) and two US consortiums successfully bid for the mine assets and began to resume production in the following month.

On May 13, China announced that it will impose tariffs on imported goods originating from the United States of about 60 billion U.S. dollars, which will take effect on June 1. Among them, the tariff on rare earth metal ore imported from the United States will be raised to 25%, which will make the ore's competitiveness in the Chinese market frustrated.

"The US government has not countered the unilateral tariff imposed on our products, which is enough to prove the US dependence on China's rare earth products." The report quoted CEO Michael Rosenthal as saying: "This will make the United States The attention of manufacturers and government officials is back to the work we are trying to do and what we can do."

Mountain Pass Rare Earth Mine Aerial View

Mountain Pass Rare Earth Mine location

Gradually lost its dominant position in the 1980s“Although imported rare earths can bypass mining quotas and related environmental laws, the 25% tariff will still make China's domestic rare earth minerals more competitive,” said David Merriman, an analyst at Roskill Information Services in London.The MP material initiative highlights the imbalance in the rare earth sector between China and the United States in complex business relationships.

The above report mentioned that since the official statistics of the United States in 1985, China has maintained a trade surplus with the United States.During the same period (in the mid-1980s), when China exploited, refining, and processing rare earth resources based on its own large reserves, Mountain Pass also lost its dominant position in the global supply of rare earths for 20 years.

To this day, China has controlled about 90% of the world's rare earth supply.The Mountain Pass rare earth mine was discovered in 1949 and contains strontium, barium, strontium and barium.Previously, a company called Molycorp has been mining here for more than half a century, but with California's strict environmental protection laws, the highly polluting and radioactive mining process is not commercially viable.

As a result, the company filed for bankruptcy protection in 2015.Rosenthal said frankly:

"Our high-quality ore gives us a significant competitive advantage in cost, but we face the opposite cost pressures from environmental compliance, labor, wastewater treatment, transportation, etc.

"Since buying the mine from Molycorp in 2017, MP materials have been adjusting and perfecting local processing facilities. This move has been the key to the latter's business plan.Moreover, this plan was further promoted after China imposed a 10% tariff on imported ore from the United States last year. But the tariffs have made MP materials sink into the US government and its biggest market, China's trade whirlpool.

However, Rosenthal pointed out that MP materials can offset the negative impact of tariffs by increasing production capacity and lowering unit costs.

“The strategic mistakes that Molycorp has made, such as investing in expensive production lines to extract low-value cerium, will be reversed in subsequent adjustments to capacity,” he said.

In addition, neodymium should be the focus.

“The price of cerium is more than four times the current price 5-7 years ago. I don’t think Molycorp would think that the price has fallen so much, so long,” said a person in charge of rare earths and battery metals.Previously, Molycorp invested nearly $1.5 billion in facilities to produce and refine available minerals, and Rosenthal declined to disclose their costs, but mentioned that the renovation could be done without new financing.

“Rare earth mining and production is stagnant in the United States”

It is worth mentioning that A-share listed company Shenghe Resources (SH.600392) is a shareholder of MP materials, not only providing equipment for the latter, but also the latter's distributors in China.

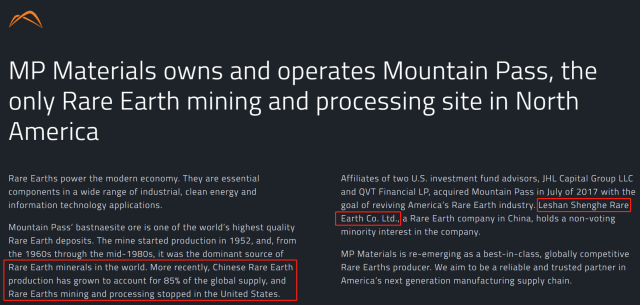

Mountain Pass Website Snapshot

In addition, according to the MP material official website disclosure, Leshan Shenghe holds a small number of non-voting shares of the company.

At the same time, the introduction also revealed that China's rare earth production has accounted for 85% of global supply. In the United States, both rare earth mining and processing are stagnant.

Merriman mentioned earlier pointed out: "(Tariffs) make Shenghe resources, as well as the US consortium, both worry. Because outside of China, there is almost no ability to process rare earths."

According to the official website of Shenghe Resources, the Mountain Pass rare earth mine is one of the largest light rare earth mines operating outside China. The rare earth reserves are about 16.69 million tons and the rare earth oxides are about 1.3 million tons:

The Mountain Pass Mine was the world's largest source of rare earths during the 1960s and 1980s. Since then, with the development of China's rare earths, the Mountain Pass mine was closed in 2002 due to competitive pressures and rare earth prices. In 2010, US listed company Molycorp invested heavily in restarting the Mountain Pass mine. However, due to the combination of technology, market and financial costs, the mine continued to lose money after the resumption of production. Molycorp entered bankruptcy in 2015.