List of Trump Tariff Targets High-Tech Minerals That the U.S. Needs

- Share

- From

- Bloomberg

- publisher

- William Chang

- Issue Time

- Jul 16,2018

Summary

Given the Trump administration's stated aim of maintaining its advantage in manufacturing prowess over China, there are some curious inclusions on Wednesday's list of new tariffs.

Given the Trump administration’s stated aim of maintaining its advantage in manufacturing prowess over China, there are some curious inclusions on Wednesday’s list of new tariffs.

Among them are rare-earths, an esoteric collection of minerals with strange names (yttrium, praseodymium), high-tech applications and a history of scarcity. They’re used in everything from hybrid vehicles to electronic gadgets and military hardware.

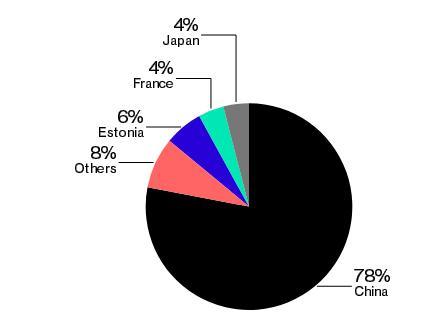

Source: USGS Imports of rare-earths compounds and metals; Imports from Estonia, France, and Japan were derived from mineral concentrates produced in China and elsewhere |

||

China Dependent

The U.S. imports most of its rare-earths needs from China

China’s grip on rare-earths supply is so strong that the U.S. joined with other nations earlier this decade in a World Trade Organization case to force the nation to export more of the materials, not less, after prices spiked amid a global shortage. The WTO ruled in favor of the U.S., while prices eventually slumped as manufacturers turned to alternatives.

Imposing duties will “bring home to the American public the reality of how much of what they use in everyday life contains these technology metals,” Jack Lifton, the Michigan-based founder of rare earth consulting service Technology Metals Research LLC, said by phone. “The Chinese mine the rare-earths, they separate them, they refine them. This is the long-term trend and a 10 percent tariff will not do anything to stir any domestic production in the U.S.”

In December of last year, President Trump signed an executive order to reduce the country’s dependence on external supplies of what the government called critical minerals -- including rare-earths, cobalt and lithium. That was aimed at reducing U.S. vulnerability to supply disruptions by identifying new sources, and streamlining regulations to “expedite production, reprocessing and recycling of minerals,” according to a White House statement.

China produced more than 80 percent of the world’s rare-earth metals and compounds in 2017, according to the U.S. Geological Survey. It has about 37 percent of global reserves and supplied 78 percent of U.S. imports.

China’s listed producers of rare-earths dropped after the U.S. announcement, which triggered a broader sell-off in global commodities. Top producer China Northern Rare Earth Group High-Tech Co. fell 2.8 percent in Shanghai to its lowest close since 2010.

Also in Trump’s sights is cobalt, an increasingly hot commodity that’s a vital ingredient in the batteries for electric vehicles. China is a major refiner of the material, which is also used in so-called super-alloys for jet engines and space vehicles, and a small but not insignificant exporter to the U.S.

“China produces as much as 80 percent of the world’s refined cobalt, and we’ve just raised our price by 10 percent,” Lifton said.

— With assistance by Martin Ritchie